FEMA Elevation Certificate

Similarly to residential properties, if the commercially-zoned land you are buying sits on a known flood plain, you may need to provide current elevation certification to determine the amount of flood insurance you’re required to carry on the property. LDP has plenty of experience in meeting the stringent FEMA requirements for accuracy in certifying the elevation of your land in relation to Special Flood Hazard Area (SFHA) zones.

Similarly to residential properties, if the commercially-zoned land you are buying sits on a known flood plain, you may need to provide current elevation certification to determine the amount of flood insurance you’re required to carry on the property. LDP has plenty of experience in meeting the stringent FEMA requirements for accuracy in certifying the elevation of your land in relation to Special Flood Hazard Area (SFHA) zones.

Why Elevation Certification is Necessary

While no one can truly predict when and where flooding will occur, the government regularly identifies and maps areas of land that are vulnerable to flooding, based on previous history. These maps are revised all the time as flood patterns are identified and refined, which means a plot of land that was not zoned for flooding 10 years ago may be in a flood zone now, and vice versa. This is why elevation certification must be updated on occasion.

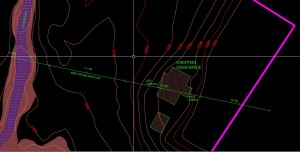

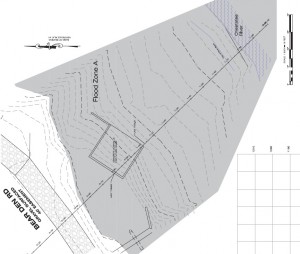

Generally, FEMA requires flood insurance to be purchased for any land on which flooding is expected to occur within the next 100 years (known as a Special Flood Hazard Area, or SFHA). The more likely flooding is to occur, the higher the premiums will be. To determine where your commercial property sits in relation to flood-prone areas, a registered surveyor must conduct an in-depth field analysis, determining the elevation of the land and any current buildings upon it. From this data, the surveyor pinpoints the location of the property on a Flood Insurance Rate Map (FIRM) and fills out a FEMA elevation certificate, a technical form of approximately fifteen pages, which is used to determine how much flood insurance will be required (if any).

How Elevation Certification Works

How Elevation Certification Works

Based upon previous history, the government identifies and maps certain areas of land that are prone to flooding. These maps are revised on occasion as flood patterns emerge. Land upon which flooding is expected to occur within 100 years is considered a Special Flood Hazard Area (SFHA), and FEMA requires any parcel of land purchased in these zones to carry flood insurance as prescribed by the National Flood Insurance Program (NFIP).

To determine whether flood insurance is needed and what the premiums will be, a registered surveyor will conduct a thorough field analysis and fill out a FEMA Elevation Certificate, a highly technical document of approximately fifteen pages. The surveyor first identifies the property location on a Flood Insurance Rate Map (FIRM) which shows the 100-year flood location and AE zones (areas with a 1% chance of flooding, also known as the “100-year floodplain”), and their 100-year flood values. The surveyor takes those values and determines the elevation of the house and adjacent ground level.

When is Elevation Certification Needed?

When is Elevation Certification Needed?

If the residential lot in question has a current elevation certificate (EC) on file and no changes need to be made, chances are you won’t be asked for a new one in order to obtain flood insurance. However, there are times when a new elevation certification is required (or when you want to obtain one on your own). For example:

- If you are making significant structural changes on the property

- If there is no EC on file because the FIRM maps were not drawn or in force the last time the property changed hands

- If the FIRM maps have been recently updated to include your property (in other words, your land is now on a flood plain when it was not previously)

- If you suspect that your property’s flood rating has changed, and you want to request a Letter Of Map Amendment (LOMA) to change its status

Whether you’re being asked for elevation certification by a lender, or whether you are requesting it on your own, it’s important to have accurate results so that you are aware of the risks in purchasing the property, as well as to keep your insurance premiums as low as possible. For more information on FEMA elevation certification, contact LDP.

Contact Us